Produce a trial balance report – Next, you should prepare a trial balance report . Generally, you should be able to generate these reports using your accounting software. Two income-statement-based indicators of profitability are net profit margin and gross profit margin.

It contains all the ways that a business brings in money, revenue, and gains and all the reasons why a business might spend money, expenses, and losses. While revenue is money entering the business through primary sources , gains refer to income that comes through secondary sources . Similarly, expenses refer to payouts necessary for the direct running of the business. Next, $560.4 million in selling and operating expenses and $293.7 million in general administrative expenses were subtracted. To this, additional gains were added and losses subtracted, including $257.6 million in income tax. The multi-step statement separates expense accounts into more relevant and usable accounts based on their function.

Are the income statement and profit and loss the same?

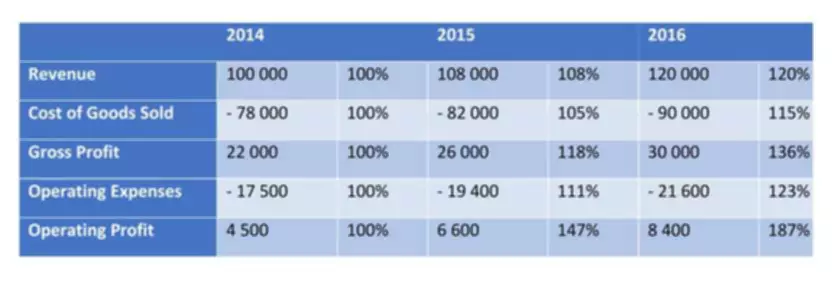

A company working on a loss would show negative numbers as the net income at the bottom of the income statement. Companies can review income statements from different periods to check for consistency, growth, or loss impact over time. An income statement represents a specific period and shows a snapshot of the profitability of a business.

Except for small companies, the amounts shown on the income statement are likely rounded to the nearest thousand or million dollars . We accept payments via credit card, wire transfer, Western Union, and bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. Consider enrolling in Financial Accounting—one of three courses comprising our Credential of Readiness program—which can teach you the key financial topics you need to understand business performance and potential. Then, in the above example, we can see that apart from normal entities, all the activities that are unusual and continuous are also taken into count.

Courses

They can be formatted in multiple columns with income and expense amounts listed in separate columns, or they can be formatted in a single column for income/expense amounts. In the instance that there is a single column for all monetary amounts, expenses are often listed within brackets to indicate that they are to be subtracted from the income. This fact is a good example of the purpose of an income statement and what it shows the user. It shows the efficiency of a company and details just how profitable the company is.

This step involves subtracting expenses and losses from incomes and gains. This income statement template was designed for the small-business owner and contains two income statement example example income statements, each on a separate worksheet tab . The first is a simple single-step income statement with all revenues and expenses lumped together.

Tax Credits

The income statement presents information on the financial results of a company’s business activities over a period of time. The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. The basic equation underlying the income statement, ignoring gains and losses, is Revenue minus Expenses equals Net income. An income statement shows the profit or loss generated by a business over a specific period of time.

- Indirect expenses like utilities, bank fees, and rent are not included in COGS—we put those in a separate category.

- Within the financial statement reports, the budget column displays the current or monthly budgets compared to actuals.

- The Excel-based system makes project control charting easy, even for those with little or no background in statistics.

- Net income is the amount that goes into the retained earnings of your balance sheet after paying out dividends if any.

- The cost for a business to continue operation and turn a profit is known as an expense.

- The purpose of income statements is to show the profitability of your business.

The biggest thing you want to look for is established trends that have been broken. For example, in Phil’s books below the spike in phone and internet expenses from $1,000 per year to $8,000 per year stands out like a sore thumb. Also, I’d be very curious to know why after five years of consistent growth, revenues from the last twelve months dropped significantly. Accrual accounting is the most accurate, but it can be a big headache to do properly. That’s why the majority of smaller independent merchants opt for cash-based accounting. The essence of the entries identified here is to provide an insight into market volatility and their possible impact on a company’s financial results when and if they occur.

It realized net gains of $2,000 from the sale of an old van, and it incurred losses worth $800 for settling a dispute raised by a consumer. The above example is the simplest form of the income statement that any standard business can generate. It is called the single-step income statement as is based on the simple calculation that sums up revenue and gains and subtracts expenses and losses. https://www.bookstime.com/ An income statement is one of the three major financial statements that report a company’s financial performance over a specific accounting period. The income statement is one of most important financial statements, because of it directly displays potential of profits. The other important documents are the balance sheet, the cash flow statement and the statement of shareholder’s equity.

How many items are in a income statement?

The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. The statement displays the company's revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

Calculate the COGS, which is the direct cost of producing goods and services. Basic EPS is the amount of income available to common shareholders divided by the weighted average number of common shares outstanding over a period. The amount of income available to common shareholders is the amount of net income remaining after preferred dividends have been paid. Find the premier business analysis Ebooks, templates, and apps at the Master Analyst Shop. Third, margins for individual products and product lines are central to product planning and managing product portfolios. The Income statement shows, for instance, Gross margin for the firm.

An income statement provides valuable insights into a company’s operations, the efficiency of its management, underperforming sectors, and its performance relative to industry peers. Total revenue is the sum of both operating and nonoperating revenue, while total expenses include those incurred by primary and secondary activities. Below is a video explanation of how the income statement works, the various items that make it up, and why it matters so much to investors and company management teams. Businesses often have other expenses that are unique to their industry. It is common for companies to split out interest expense and interest income as a separate line item in the income statement. This is done in order to reconcile the difference between EBIT and EBT. To determine your business’s net income, subtract the income tax from the pre-tax income figure.

- This represents the company’s earnings from regular activities and is a reliable basis for the measurement of a company’s profitability.

- Unlike the balance sheet, the income statement calculates net income or loss over a range of time.

- The reports reflect a firm’s financial health and performance in a given period.

- Therefore, it shows how much money a company made and spent over the period.

- In our example, the operating expenses are divided into Selling Expenses and General Expenses.

- After deducting all the above expenses, we finally arrive at the first subtotal on the income statement, Operating Income .